On Twitter yesterday, Melissa Clouthier and I had another one of our epic back-and-forth tweet-debates, complete with multi-part tweets (mostly by me) and rhetorical fireworks. Melissa is on record as calling me her “blog husband,” so is it any wonder we bicker on Twitter like an old married couple? Heh. Anyway, this time, the topic was “unexpectedly” bad economic news — something there’s seemingly been a lot of lately (see below) — and conservative mockery of the notion that it’s perpetually “unexpected.”

It all started with this tweet by me. Melissa responded. I responded back. Eventually, @PoliticalMath joined in (kinky!). The rest is history… history which I’ve decided to reproduce here. As I did last time, I’ve re-organized the tweets into paragraphs — combining multi-part tweets where appropriate (for instance, at one point I “say” three paragraphs in a row; that’s actually eight consecutive tweets) and moving things around a little bit in temporal order, so that the conversation will make sense to a reader. But again, I haven’t done any substantive retroactive editing. This is a faithful, and for the most part verbatim, representation of the conversation we had:

Me: I can’t decide whether I think this burgeoning conservative meme mocking the “unexpectedness” of “unexpected” economic news is dumb or not.

Melissa: I focused on the “unexpected” deal a couple months ago. The whole orientation is shock. If Republican it would be “expected.”

Me: See, it’s that argument that makes me think the meme is dumb. The “expectations” are coming from experts, not journalists. Or [from] market expectations. Economic news always has to be filtered through market/expert “expectations” because those are already priced into market, so bad news that’s unexpectedly good is “good,” and good news that’s expectedly bad is “bad.”

To claim this has something to do with media bias is, I’m sorry, absolute paranoia. Media bias exists, but this isn’t it. The media-bias analysis doesn’t even make sense on its own terms. Media seeking to help Obama would PLAY DOWN expectations.

For the meme to have value, it must ask whether markets & experts (not MSM) are consistently too optimistic, and if so, why. You also need to look at instances when economic indicators have been “unexpectedly” GOOD, which has happened plenty of times during the Obama Administration, though less so in the last few months. It’s partisan tunnel vision to pretend otherwise.

Melissa: Quite simply: you’re wrong. I suggest that you go through the main newspapers’ interpretation of economics. When something bad happens, it’s always a shock, unexpected, downplayed.

Me: This is facially nonsensical. In news terms, “unexpected” is the OPPOSITE of “downplayed.” To downplay something, one must posit that it was “expected.” If bad news was expected, it can be downplayed. If it’s unexpected, it’s a bigger deal.

[Moreover,] I can recall plenty of times in ’09 when we were hearing about “unexpectedly good” economic news, when trend line was going up.

Melissa: Were President Obama a Republican, the headlines would be: “Worst economy ever” and there’d be stories about street people.

Me: That may be true, Melissa, but it’s a separate issue from the nonsensical & factually false claim that all bad economic news is ALWAYS reported (if under a Dem prez) as “unexpected,” and all “unexpected” news is ALWAYS bad news. That’s just false.

Melissa: You’re being logical and assuming the press is the same. They are emotional & surprised at any failure.

Me: No. This is nonsense. “Expectations” come from markets and experts, not the media. Your MSM obsession is blinding you. You are prone to lazy thinking about certain issues when you see a “media bias” angle. Not everything is about the media.

Political Math: I think @brendanloy is right on “expectations”. They come from economists, not the media. But I think @MelissaTweets is right, media is “downplaying” the economic situation, although that is mostly by omission.

Melissa: I disagree. It all depends on the economists questioned and the press chooses whose expectations get attention.

Me: You’re wrong, @politicalmath is right. MSM may well be “downplaying,” but that is a separate issue from “expectations” meme.

Melissa: You get 10 economists in a room, 10 opinions. The press picks a favorable economist & is surprised when wrong.

Me: Again: nonsense borne of lazy, MSM-obsessed thinking. There is an expert/market CW consensus, that’s what’s reported.

Political Math: The “expectations” come from the BLS… pretty well respected & non-partisan http://bit.ly/caGvWX

More after the jump.

Me: Now, let me be clear. (Heh.) I’m talking about “expectations” as reported in things like AP articles. I don’t doubt that cable news commentators say ridiculous things about the economy. I don’t watch them. I don’t consider them news. If I want smart economic commentary, I don’t go to Olbermann or O’Reilly, I go to NPR or WSJ.

Melissa: Correct and I go to Maxed Out Mama and Calculated Risk. Also WSJ. But I watch the MSM and see the non-stop shock. Annoying.

Me: Your memory is distressingly selective. In the second half of 2009, there was lots of “unexpected” GOOD news. You should be criticizing the popular media for *shallowness* in economic coverage, not bias-driven “non-stop shock” over bad news.

Melissa: It’s all the same. The shallowness/shock deal.

Me: No, it’s NOT the same, because shallowness is nonpartisan, whereas you make EVERYTHING about partisan/ideological bias. “Shallow” reporting is not consistently pro- or anti-Obama, but it’s always a disservice to the public. THAT should be focus. Your obsession with the “bias” angle, which is but one part of the dysfunctional media picture, obscures that reality.

Indeed, in a way, making EVERYTHING about “bias” lets MSM off the hook. Journalism’s problems run so much deeper than that. And viewing all MSM issues solely through the lens of “bias” is just as “shallow” as the shallow reporting you’re criticizing.

Melissa: Perhaps, but the first step is recognizing the filter through which all of the news is portrayed.

The next part of the conversation was actually a separate thread that was happening, in part, simultaneously with the above, but it made more sense to break it out separately:

Political Math: That we have a lot of “unexpected” stuff happening if more due to the fact that this really is a very weird recession.

Melissa: It is a weird recession but there have been some people consistently getting it right.

Political Math: But people have only gotten it consistently right in the “things are going to get better & then worse” way. I don’t think anyone has been consistently right in a “We will lose 125K jobs next month” way.

Me: Hmm, so instead of going with broad-based consensus, reporters should hand-pick experts they think have best track records? I thought hand-picking favored experts was what you *oppose*.

Political Math: I’d like to see the press report in a “higher/lower than estimates” rather than “expectations” Using “estimates” reveals we can’t tell the future. “Expectations” implies we can.

Me: I’m @brendanloy and I approve @politicalmath’s message in the last several tweets 🙂

Melissa: I would like a pure economists “stock market”, see their predictions and see who is consistently right.

A bit later, Melissa tweeted, “So, I’m being told that @brendanloy wins this round. 😉 Win some. Lose some.” Political Math replied, “I enjoy it when you & @brendanloy go at it :)” to which Melissa responded, “Well, @brendanloy has been a longtime blog-friend and I respect his opinion even when he calls me names. ;)” Meanwhile I wrote, “LOL! I was going to make this into a blog post again, but if my victory is being conceded, that feels like rubbing it in,” to which Melissa replied, “Ha! Well, I’m not sure you entirely understand where I’m coming from.” I responded, “That’s very possible, if not probable. Impossible to convey nuance in 140 characters. Hence my constant multi-part tweets :)”

Meanwhile, there is talk of Political Math and I being on a Melissa’s podcast sometime in the coming weeks, so stay tuned.

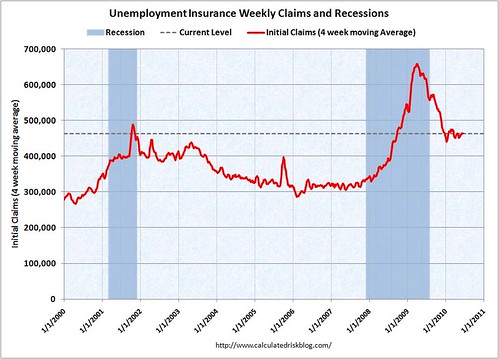

[Scary job chart at top from Calculated Risk, via Sully — that Tough, Self-Sufficient Bear.]

Well, my only comment is that if all of this “unexpected” bad economic news really was unexpected, perhaps we need to find new “experts”……..

Oops, they did it again:

Sales of U.S. previously owned homes unexpectedly fell in May,

http://www.businessweek.com/news/2010-06-22/purchases-of-u-s-existing-homes-unexpectedly-fall-correct-.html

Yeah, there was some Twitter noise this morning about that.

uhhmmm…..

New claims for jobless benefits unexpectedly rose last week, while manufacturing activity slowed in June, heightening fears the country’s economic recovery was stalling.

http://ca.reuters.com/article/businessNews/idCATRE65M2WK20100701

Yeah, I’m on this one too.

I still don’t see how inflated expectations are a left-wing, pro-Obama MSM conspiracy — like I said in this post, it would benefit Obama to depress expectations, thus turning bad news into good (or at least not-so-bad) news — but it is getting a little silly.

It’s “unexpected” because the media and political elite actually bought into the Keynesian garbage of stimulus spending being an economic multiplier. So now they’re surprised the economy is faltering, while the rest of us are snickering and saying, “I told you so”.

Sorry about missing the tweets…..it is my intention to be the last person on Earth who doesn’t own a cellphone (and gets to say “I told you so” to the rest of you when it is proved they cause cancer) so tweeter is a bridge too far for me.

LOL… no need to apologize, you are under no obligation to read my tweets! Especially the ones that don’t appear on the blog (which includes anything where the first character is @ — i.e., tweets that are “responses” to another person — and anything where I include the characters *# in order to deliberately keep it off the blog).

Well..at least they are changing the wording a little….”much more than expected” rather than “unexpectedly”…but I would argue there is no difference in meaning…….

New orders for factory products tumbled much more than expected in May, posting their sharpest drop since the depth of the recession and their first decline in nine months, a government report showed on Friday.

http://abcnews.go.com/Business/wireStory?id=11072590

Americans’ use of credit unexpectedly plunged by $9.1 billion in May, a 4.5% annualized rate, the U.S. Federal Reserve announced Thursday. Equally significant, April’s consumer credit statistic was revised to a large $14.86 billion decrease, a substantial change from the previously-released $1.0 billion credit increase.

http://www.dailyfinance.com/story/credit/consumer-credit-plunges-in-may-april-revised-downward/19546497/

Unexpected Drop in Durable Goods

http://www.nytimes.com/2010/07/29/business/economy/29econ.html?_r=3&hp

The Dow Jones industrial average gained more than 100 points for the third straight day Monday after investors got some unexpected good news about the economy. A report on the housing market came in better than expected. And shipping giant FedEx Corp. released a forecast that was more upbeat than the prediction it made just six weeks ago.

http://www.courierpostonline.com/article/BL/20100727/BUSINESS/7270316/Unexpected-good-news-dispels-pessimistic-mood

Unexpected drop in jobless rate fuels optimism

http://www.msnbc.msn.com/id/34272155/

Jim:

Good or bad, unexpected is unexpected.

Yes, gahrie. Precisely. But that’s NOT what Melissa Clouthier and others on the Right have been claiming, and you have seemingly been supporting, which is the theory that the MSM is somehow conspiratorially trying to help Obama by peddling unrealistically high expectations (a theory that is illogical on its face, as I point out in this month-and-a-half-old post — the proper course of action for a pro-Obama conspirator would be to depress expectations, not raise them — but we’ll leave that fact aside for the moment). If the allegation is merely that the MSM (or, more accurately, the economic/market consensus upon which the MSM is basing its “expectations’) is dumb and frequently wrong, that’s perhaps a fair claim — I might even agree with it — but it’s entirely different from the claim that the economy is consistently underperforming “expectations” to a degree that suggests some sort of pro-Obama bias in the expectations themselves. Are you not making the latter claim? If you aren’t making it, then fine, but if you are making it, then “good or bad, unexpected is unexpected” seems to undercut it.

Reread my first post on this thread.

My basic point is that the “experts” that Pres. Obama claims to be relying on, are wrong more often than they are right.

And saying that…..

Jobless Claims in U.S. Unexpectedly Climb to Three-Month High

http://www.bloomberg.com/news/2010-08-05/jobless-claims-in-u-s-unexpectedly-climb-to-three-month-high-of-479-000.html

Besides, my theory on the media’s use of “unexpected” is that they aren’t trying to lower expectations, but are instead trying to deflect accountability.

Stocks were deeply in the red Wednesday after the U.S. trade deficit widened unexpectedly and a string of weak economic reports from Asia and Europe heightened concerns that the global recovery is veering off track.

http://www.washingtonpost.com/wp-dyn/content/article/2010/08/11/AR2010081103472.html

Still going….

The U.S. economy unexpectedly shed jobs in September for a fourth straight month as government payrolls fell and private hiring was less than expected

http://www.cnbc.com/id/39571732

You know, if not only remembered for being dense, I think of you everytime I hear “unexpectedly” positive economic news now. Then I think, man, I should post a link about this! Then I remember that you’ll retreat into your farce about how it’s not necessarily that you think it’s always unexpectedly bad, but just that it’s bad that so many things are unexpected! And then, of course, after the smoke clears, you return to exclusively posting unexpectedly bad numbers.

gahrie – it would seem that what Jim is trying to tell us is that he would like to see more posts/comments from us about good numbers, rather than just pointing out the now-obvious excessive overuse of the blame-deflection “unexpected” …

Of course, it becomes a real challenge to find good numbers that also say “unexpected” …

So … perhaps we can satisfy Jim with …

Good Yet Unexpected Numbers here …

Or (and, admittedly, I had to go back to 2006 to find it, yet the comparison with nowadays is instructive) “The unemployment rate fell to the lowest level in more than five years in October, the government reported Friday, a sign of unexpected strength in the job market. The jobless rate sank to 4.4 percent from 4.6 percent in September, the Labor Department said. It was the lowest since May 2001.” (from 11/03/06)

Is that better, Jim ?

Yes, it is. You could also use unexpectedly good news from recent reports, as I did above. The point, and it’s been explained to fucking death in this thread, both by myself and Brendan (if not anyone else) is that the idea that things are unexpectedly bad all the time because of some sort of bias in the expectations is ridiculous.

Jim #22 – thank you …

Is it possible for you and Brendan et al to admit that gahrie and myself et al keep commenting on the bias shown by the MSM’s now-obvious excessive overuse of the blame-deflection “unexpected” ?

New home sales unexpectedly fall in October

http://www.reuters.com/article/idUSTRE6AN3HT20101124

Orders to U.S. factories for long-lasting manufactured goods plunged in October by the largest amount in 21 months, reflecting widespread weakness in a number of areas.

Orders for durable goods dropped 3.3 percent last month, the Commerce Department reported Wednesday. The setback was the sharpest decline since demand fell 8 percent in January 2009, a time when the economy was caught in the worst recession since the 1930s. Excluding transportation, which is often volatile, orders were down 2.7 percent, the biggest drop for this measure since March 2009.

The unexpectedly sharp declines raised questions about the strength of manufacturing, which has been one of the economy’s standout performers. (emphasis mine)

http://www.google.com/hostednews/ap/article/ALeqM5jJVUpPPqrD8zIUGm-YzdxzqDnaCQ?docId=5820d62a0c4044b7b1df476222258755

At some point, don’t these guys have to start expecting these things just to try and cover their ass?

By the way Jim..feel free to post links to any unepectedly good news…..I could use some cheering up…..

U.S. economy grows faster than expected in third quarter

http://www.latimes.com/business/la-fi-economy-gdp-20101124,0,5630241.story

David K #28 – from that cite – “But the most recent increase in GDP still isn’t strong enough to make a dent in the country’s high unemployment rate, stuck at 9.6% in recent months. Analysts say GDP growth of at least 3% is needed to bring down the jobless figure, but many don’t expect the economy to perform that well in the fourth quarter or early next year.” …

Apart from the fact that the source is barely valuable to line bird-cages or to train recalcitrant canines, it’s sorta depressing that this is the best even David can find as ‘good news’ …

Funny, when I heard the news that David K posted, I thought of you Gahrie, as I do every single time I hear about something unexpectedly positive (which at this point is basically as often as unexpectedly negative news).

Your retort to his link is classic. Nice moving of the goal posts. But that’s what you’ve done this entire thread. You post a string of “unexpectedly bad” news, then when shown a bunch of things that are unexpectedly good you act for a short period of time like you really are just complaining about how imprecise everything is.

You are just a troll, go away.

Oh, nice, I actually thought Alasidair was Gahrie. I’m not really sure I need to change my response, however.

Umm – Jim K – just what was *actually* good about what David K cited ?

‘not as bad as it might be’ just ain’t the same as good, in the minds of most reasonable people …

Jim:

Let me state my only point explicitly, since you seem to be confused.

All of the experts that Pres. Obama has surrounded himself with, and are attempting to run this country, are continuously wrong in their predictions, confused in their prescriptions and caught unaware by events. the MSM then attempts to cover the experts’ ass by describing everything as “unexpected”.

Go re-read the very first post on this subject.

Gahrie, we followed you advice @ #1, we got rid of Bush’s economic expert’s who destroyed the economy and did not see the disaster coming. Obama has been working to repair the damage. Disasters take time to clean up and despite the fact that it is taking longer that we like, keep in mind that it took the Rangers a decade to recover from the destructive power of having Gorge W. Bush at the helm.

Now the American people have returned the people that got us into this mess to power. I think we may well be the only country that votes ironically. Fucking hipsters.

Gahrie: Economic forecasts are not precise. That doesn’t mean they aren’t useful. Grow up.

Gahrie: Economic forecasts are not precise. That doesn’t mean they aren’t useful. Grow up.

I’m not the one saying that it is unexpected when the experts get it wrong. I expect them to get it wrong….save your contempt for the MSM and politicians who apparently believe the experts can get it right.

gahrie – yet again, Jim K proves himself to be part of the Projective Party …

Rational folk took a look at what got the US into the Great Depression after the market downturn of 1929 and were horrified to see the current occupant of the White House cheerfully ‘leading’ his Cabinet and his Congress to follow way-too-close-to-equivalent policies – and unexpectedly, we have the current economy and unemployment numbers …

Just remember – it’s all Booosh’s fault – and *we* are the ones who need to “grow up” …

Then again, there is always the picture worth many K words … and you can see who is responsible, here …

Gahrie: I think what you are missing is that nobody anywhere expects economic forecasts by anyone to be precise. There is nobody in existence that consistently guesses correctly what the economy will look like in the future, and if they tell you otherwise they’re lying. Projections are our best guess at what’s expected. When the result deviates from that, it’s unexpected. I’m not really sure why this is so hard for you to understand or why you think it’s somehow a partisan issue, or even a political issue. It’s not. Economics is an imprecise trade by its nature.

And Alasdair, we’ve already had this conversation and you were proven wrong, in fact, you simply stopped replying in the thread. So I don’t quite get why you’d want to go back to that.

And I never said the economy was all Bush’s fault. Not only that, I believe the good economy in the 90s didn’t have much to do with Clinton. The economy is largely cyclical. The current downturn is obviously much larger than the normal cycles, but I don’t think anyone could have expected Bush to have anticipated it. I do think his preference for less regulation both did not help the situation (although I don’t think you can draw a straight line from him to that) but more importantly wouldn’t be the right solution. But no, it’s not all Bush’s fault. But it’s also *not the Dem’s fault at all*.

Which brings me to your stupid link. What do you think this shows? Surely not the same thing as the idiot that posted it to his blog? Change overs occur at various times through the unemployment cycle, so really, I’m confused, I need it explained to me.

In the first change over, we see continued declines in unemployment under a Democrat-controlled Senate after highs under a Republican-controlled Senate (curious how they don’t extend a couple years earlier to show unemployment sky-rocket under a Republican-controlled Senate). After years of these continued declines, another spike occurs (although not nearly as high as the previous spike under the Republican-controlled Senate), only to have it decline again under the Democratic-controlled Senate.

We then see continued declines under the new Republican-controlled Senate (the ’95 changeover) until it troughs and power changes hands again to the Democrats. Considering they take power at the bottom of the trough this tells me that the problems already existed, not that they created them.

Again we see declines until the Democrats come in during another trough, again implying the problems already existed. The economy isn’t a speedboat, it’s a supertanker. It doesn’t change course over time.

If you wanted to try and lie with statistics I’d suggest starting in ’95, since everything before that shows precisely the opposite of what you want to show. At least with the shortened chart you could convince people who think the economy turns on a dime. Certainly we all know now that the issues that caused the collapse in this last downturn were occurring, and indeed reached their height before Democrats took control of the Senate.

Gahrie: I think what you are missing is that nobody anywhere expects economic forecasts by anyone to be precise. There is nobody in existence that consistently guesses correctly what the economy will look like in the future, and if they tell you otherwise they’re lying. Projections are our best guess at what’s expected. When the result deviates from that, it’s unexpected.

This makes no sense.

Your position is that the experts make predictions that everyone expects to be wrong, and then when they turn out to be wrong, the results are unexpected? How does that make any sense? A rational response would be..”the experts were wrong, just like we expected them to be.”

No, my position makes perfect sense. It is expected that reality will not be precisely what they predicted, but it is unknown (and hence unexpected) in which way reality will break. Things either end up unexpectedly bad, unexpectedly good, or pretty damn close to predicted.

Businesses do the same. They make projections about how they think their quarters will be, as do analysts. These are rarely accurate. They are unexpectedly better sometimes, unexpectedly worse others. Things are never predictably worse than expected because if so you would have predicted it in the first place.

So are you saying that every business is a bunch of morons too?

No…I am saying that if you are expecting bad news, or at least recognizing that it is probable, then by definition it is not unexpected.

I am also saying that relying on the predictions and recommendations of the experts because they are members of that class is foolhardy.

I am saying that the media attempts to compensate for the shortcomings of the “experts” by routinely labeling results that disagree with the predictions as unexpected.

Business gets punished when they make poor predictions. (or at least they used to, before they became too big to fail) Experts just write another book.

Again you are conflating issues, or rather your true intentions with all these posts is telling. The prediction itself is not making a value judgment about whether it is good or bad. It just is. “Unexpectedly bad” and “unexpectedly good” is relative to the original prediction.

And your point about relying on the predictions of experts being foolhardy is laughable. Who will we rely on then? Joe the Plumber? In the real world businesses must make investment decisions based on what the landscape is expected to look like. And while they hopefully recognize nobody is perfect, they know that the experts you dismiss are the best thing going.

And yes, sometimes businesses do get punished when they make poor predictions, as they do all the time. If things are unexpected in a bad way they may be left with inventory they can’t move. If it’s unexpectedly good they may not have enough inventory to satisfy demand.

Either way, the phenomenon manifests itself in the same way, predictions are made, and they’re rarely accurate. Things usually end up better or worse than predicted. This blows your little pet theory out of the water. The lamestream media can’t be blamed for this.

gahrie – it seems that there is hope for Jim K, yet …

He actually realises that “In the real world businesses must make investment decisions based on what the landscape is expected to look like. “ … and in today’s world, due to the current Congressional hyper-incompetence, busineses are in so much uncertainty that they are *not* hiring people back … even something as simple as agreeing to extend the Bush cross-the-board tax cuts, is apparently beyond the current CongressKrugmen …

Before I forget, Jim (Projective) K – “And Alasdair, we’ve already had this conversation and you were proven wrong, in fact, you simply stopped replying in the thread.” – would you care to explain what comments #23 and #24 show ? Apart from *you*, having been proven wrong, stopping replying in *this* *very* *thread* ?

Again you are conflating issues, or rather your true intentions

When did you learn to read minds?

You are projecting a strawman you built onto me.

I have been consistent in both point and argument this entire thread.

gahrie – you have to admit, Jim K has been consistent, albeit in that davidkian way, too !

even something as simple as agreeing to extend the Bush cross-the-board tax cuts, is apparently beyond the current CongressKrugmen …

This has nothing to do with the topic at hand. You are either just trying to score cheap political points or more likely trying to distract from the point at hand.

Regarding what #23 and #24 show… uh… nothing And re: your bolded statement, are you drunk? That doesn’t even make sense.

@gahrie, #46: Well I disagree that you have been consistent, but it’s irrelevant. It seems you have no retort for the fact that businesses also make in accurate projections and as such I’ll assume you’ve accepted that you’re wrong.

Jim…I’ll type this slowly for you….

My biggest beef is not with the experts….either governmental or business

My problem is the people who rely on the “experts” and expect them to be accurate despite their track record, and the MSM who covers up the incompetence of the “experts” by consistently reporting the failed predictions as “unexpected”.

Hmmm…timely….

http://online.wsj.com/article/SB10001424052702303891804575576523458637864.html?mod=wsj_share_twitter

From the above article:

The main flaw in the dominant models, he says, is the same feature that makes them so attractive to policy makers: Their ability to make precise predictions. To generate their predictions, the models assume that people, firms and other players always make decisions in the same way. The players must also share the same beliefs about the exact probabilities of various outcomes, such as a rise in car prices or tax rates.

“It’s like socialist planning,” says Mr. Frydman. “If we really knew that much, we could have Communism and God knows what.” Capitalism works better than other systems, he says, because it lets people disagree about the future and profit from their insights—rational behavior that models don’t accommodate.

@Gahrie, #50: Then your problem is with business. Again, current economic models are the best thing we have.

Its like weather forecasting. It’s not that good, but it’s what we have. We accept its flaws and use it.

Weather forecasters speak of “chances” and “percentages” of things happening….economic “experts” don’t.

gahrie – money quote from the article … “People aren’t quite as rational as models assume” …

It contains two significant parts …

“as models assume” – too many people believe that models’ predictions are valid (that’s the “assume” part) … those of us who work with models on an everyday basis eventually learn that a model is a tool – which may work and may not work – and we verify whether or not it is working, on a regular basis … hence, we are sceptical about the Cult of AGW precisely because the models for AGW seem only to work when tweaked, adjusted, and/or faked … when the model doesn’t work, one must adjust/scrap&create anew the model, and one must *not* adjust the data to fit …

“People aren’t quite as rational ” – except that people are every bit as rational as they *choose* to be, each with his or her *own* rationale for his or her own version of what “rational” is for that person … Brendan’s “rational” is not the same as *my* “rational” and it is most likely that dcl’s “rational” is different from each of ours … “The Market” doesn’t require that all “rationals” be the same – whereas socialism tends to require that everyone accept the same “rational” whether it is National Socialism or Soviet Socialism or Ba’athism …

Successful models allow for and eventually track and often can predict behaviour, in many systems … the successful ones for humans tend not to require everyone to think the same … as an example, a successful advertising campaign usually implements a model which the advertiser hopes will induce people to buy the product(s) produced by the advertiser … is the (socialist) Lada or the (Market) Toyota the better car ?

Current (as in US Federal) economic models as extolled by Krugman (Nobel prizewinner) don’t work … what the US Feds are doing right now seem right out of the Hoover-then-FDR playbooks – and that’s greatly depressing …

The out-of-favour-Laffer model(s) predicted that lowering tax rates within reason would lead to significant tax revenue/income for the US Feds – and Laffer was proven right … Kennedy cuts proved it, Reagan cuts proved it, Bush cuts proved it …

On the separate issue of deficits, independently of tax revenue levels, Congress tends to spend, sometimes like a drunken sailor (under Bush), recently like a drunken sailor high on crystal meth (under Obama, for a short time under Clinton ’93-’94, under Carter) …

Current economic models are NOT the best to which we have access – sadly, they are the best which the current Occupant of the White House and the current leaders of Congress seem willing to consider …

The meme rolls on…….

http://pajamasmedia.com/instapundit/117311/

Anyone want to predict how soon the “unexpectedly” tag drops off of bad news once the next Republican is elected president?

Wow..even Barone picked up on it……nearly a year later…..

http://washingtonexaminer.com/politics/2011/05/pro-obama-media-always-shocked-bad-economic-news

http://pajamasmedia.com/tatler/2011/06/09/expect-the-unexpected/

I *knew* a bunch of us were thinking that !

(grin)

http://punditpress.blogspot.com/2011/06/unexpectedly-compilation.html

Brendan Loy

@KilroyFSU I see conservatives harping on this constantly. Rant triggered by http://t.co/LQoEcmS, linked in a blog comment by @gahrie.

When there was bad economic news under President Bush was it described as “unexpected”? Has any bad economic news under President Obama been called “expected”?

I will be honest, I have three reasons for continuing to update this thread.

1) The press continues this tactic of downplaying bad economic news for the Obama administration. It should also be noted that they continue this tactic despite conservatives “harping on this constantly”.

2) I am planning to link to this thread when the press fails to describe bad economic news as “unexpected” under the next Republican administration.

3) If this meme is not an example of media bias, then it is certainly an illustration of the fallibility of the country’s economic elites.

I don’t know if you read the entire tweet-rant of which that one tweet was a part, but here it is:

Dear conservatives: “unexpectedly” refers to market analysts’ expectations, not the MSM’s. It has nothing to do with Obama-worship. NOTHING.

“Unexpectedly bad” simply means “things are even worse than we thought.” Reporting this fact IS NOT HELPFUL TO OBAMA. Just the opposite!

A shill for Obama wouldn’t say “this is unexpectedly bad.” He’d say “it’s bad, but we expected it to be bad, and hey, it could be worse!”

The “unexpectedly” stuff is *funny*, but it’s not a serious political point or argument. As an actual serious meme, this is an #EPIC #FAIL.

The reason economic news is always framed in terms of “expectations” is because that’s how markets work. Expectations are priced in.

So what matters to the markets isn’t so much whether the news is good or bad, but whether it’s better/worse than expected. MSM mimics this.

It’s empirically false that u never hear “unexpectedly good.” When it’s true, u hear it. Just hasn’t been true much lately, because, #PANIC!

Now, if MSM sometimes misstates analyst expectations, or if analysts are frequently wrong, those are legit gripes. But it’s NOT ABOUT OBAMA!

When there was bad economic news under President Bush was it described as “unexpected”?

December 3, 2004: “November job growth unexpectedly soft”

October 14, 2005: “Consumer Confidence Falls Unexpectedly”

September 7, 2007: “U.S. Economy: Employment Unexpectedly Drops in August”

Those are just the first three I found with a quick Google News Archive search. There are countless thousands others. This is how economic news is always reported. Good or bad, economic news is always compared to the market/analyst “expectations.” The fact that you didn’t start paying attention to this phenomenon until 2009 is not my problem, or the MSM’s.

Has any bad economic news under President Obama been called “expected”?

This one is harder to answer, because of course, something that’s exactly as “expected” isn’t very newsworthy, and thus is unlikely to generate headlines. However, here are some examples of good economic news under Obama being called “unexpected,” which equally undermines your premise:

April 1, 2009: “Stocks begin Q2 higher after better-than-expected economic reports”

September 1, 2010: “Wall Street cheers unexpectedly good economic data”

June 14, 2011: “Dollar mixed after better-than-expected data”

June 16, 2011: “Jobless Claims, Housing Starts Better Than Expected, Helping Futures”

Boy, I really had to dig hard to find those last two, from earlier this month.

Your entire premise is demonstrably false. The end.

Now, if MSM sometimes misstates analyst expectations, or if analysts are frequently wrong, those are legit gripes. But it’s NOT ABOUT OBAMA!

No one said it is about Obama.

It is about the media trying to protect Obama and /or the constant failures of his/the economic experts.

see post #1 and post #33

The fact that market expectations often are not exactly right — and thus, a given set of data will often be “unexpectedly” good or “unexpectedly” bad — is not a sign of “constant failure.” It’s a sign that nobody is very good at predicting the future. If expectations were consistently wrong in one direction, that would be a sign of failure, but that just isn’t true. Right now, we’re seeing more “unexpectedly bad” news than “unexpectedly good” because the economy has taken a turn for the worse. But when things are improving, we see more “unexpectedly good” than “unexpectedly bad.” That’s just how the world works! Your incredibly selective memory is the only “failure” at issue here.

Post #33 is a non-sequitur. The “expectations” in question aren’t set by “the experts that Pres. Obama has surrounded himself with, and are attempting to run this country.” They’re set by professional, private-sector analysts, and by investors. We’re taking market expectations. When the media says “unemployment claims were unexpectedly high,” they don’t mean “higher than Tim Geithner expected,” they mean “higher than the market expected.”

You really just couldn’t be any more wrong about this. You’ve staked out two alternative positions — either they’re “protecting” Obama, or they’re “protecting” the “experts” — and both of these positions manage to be completely incorrect.

Do you really think it is unexpected for people to notice/comment on that virtually every economic report is unexpected, revised to be worse and never attributed to anyone who can be held responsible?

These “experts” whoever they are are paid millions to be continuously wrong.

See comment #66.

As I wrote on Twitter, if market analysts could perfectly predict what the economy would do (or even get it right 90% of the time), nobody could make any money in the markets, because everybody would always know what to expect! Nobody could make a bold prediction and outsmart his fellow investors, because all investors would always know what to expect. Everyone would have perfect knowledge about everything. But of course, this is impossible! It’s baked into the system that market analysts will frequently be wrong! The good ones, who make the most money for themselves or their clients, are wrong least often, but they’re still wrong a lot! (“Wrong” being defined as simply “not exactly right,” such that the actual numbers are either somewhat above or somewhat below the expected numbers.)

Now, you might say, why bother to predict the future at all, if everyone is going to be wrong all the time? But the analysts’ expectations form the window within which the actual results are judged. For instance, suppose the market/analyst consensus indicates that jobless claims will be 420,000 this week. Instead, it’s 430,000. “Unexpectedly bad!” Or perhaps 410,000. “Unexpectedly good!” According to you, this is a symptom of “failure,” as is any non-perfect prediction of the future. But aren’t we better off having a baseline expectation of 420,000 that allows us to make sense of what actually happens, rather than wandering in the dark, having no clue what to expect — 300,000? 500,000? — and having no idea whether any given set of data is, relatively speaking, good or bad news? Economic data would be a bunch of meaningless noise if we didn’t have some sort of baseline “expectations” to judge it against. This is true in recessions — when “bad” news can be “good” (things are bad, but getting better; recovery is coming) or “bad” (things are worse than we thought; #PANIC!) — and it’s also true when the economy is growing — when “good” news can actually be “bad” (unemployment is low, but it “should” be lower) or “good” (wow, that’s even more growth than we expected!). Because trends matter, and because expectations are priced into the market (not just the stock market, but also consumer confidence, business decision-making processes, etc.), it’s absolutely essential to know what the expectations are, at least in general terms.

It’s also crucial to note that we’ve engaged in no analysis whatsoever of HOW BADLY WRONG predictions tend to be — you’ve presented no evidence or argument on that point. Instead, you’re comparing “expectations” to a standard of perfection. Anytime the actual numbers are “unexpectedly high” or “unexpectedly low,” meaning simply that the prediction wasn’t exactly right, you cite this as evidence of failure. So in essence, you’re dismissing the expertise of those who attempt to predict the future on the basis of the fact that predicting the future is hard, and results imprecise. It’s like saying the weatherman is a failure because he thought the high temperature would be 82, and instead it was an “unexpectedly warm” 84.

Bottom line, you haven’t remotely demonstrated that “these ‘experts’ whoever they are are paid millions to be continuously wrong.” You’re simply pointing out that, compared to a standard of perfection, predictions are usually off at least somewhat in one direction or the other — which you object to, so you apparently take issue with the whole enterprise of predicting the future, or else you think such predictions should be 100% perfect. Both of these positions are nonsensical.

I’ll say it again, and this has nothing at all to do with ideology: As a matter of simple facts and logic, you really just couldn’t be any more wrong about this.

virtually every economic report is unexpected

This is false. But “expected” reports are less newsworthy, and don’t make headlines. Duh.

…revised to be worse…

This is baloney wrapped in bullshit covered with hogwash. As new information comes in, reports are sometimes revised to be worse, and sometimes revised to be better. Are you really going to make me go back to the Google News Archive? I could eviscerate this assertion just as easily as I eviscerated the notion that there was never “unexpectedly bad” news under Bush, or “unexpectedly good” news under Obama. Your selective memory is not evidence of experts’ failures, or the media’s.

…and never attributed to anyone who can be held responsible

This is at least an arguably valid point. The media could probably do a better job of citing specific sources, or at least making clear what it means by “expectations.” But really, when the stock market tanks on unexpectedly bad economic news, do you need some academic to tell you it’s unexpectedly bad, or does your common sense tell you that, since market expectations are priced in, a negative market reaction to economic news pretty much means by definition that it’s unexpectedly bad?

According to you, this is a symptom of “failure,” as is any non-perfect prediction of the future.

I do not necessarily fault the experts for being wrong. It is entirely possible that you cannot accurate predict the future of the system, just as we cannot accurately predict the future of the climate.

I fault those who tell us to shut up and listen to the experts/elite because they know so much more than us, even though the elites/experts are continuously and predictable wrong. In fact, as you tell us, we should have no reasonable expectation that they are right.

I fault those who continue to describe economic reports as “unexpected”, if as you state, we have no reasonable expectation that they will be accurate.

You’re simply pointing out that, compared to a standard of perfection, predictions are usually off at least somewhat in one direction or the other — which you object to,

No. I object to labeling the results as unexpected. According to your argument, accurate results are the ones that should be label unexpected.

Ahhh – with my unexpected limited internet access this week, I have *ALMOST* been in withdrawal …

Brendan seems to be unexpectedly missing or not noticing or not choosing to perceive gahrie’s point …

If I may paraphrase my understanding of gahrie’s point … when various folk tell us that the Stimulus is not going to work as predicted/promised, and then it doesn’t work, it can be irritating to see the failure to work described as “unexpected” …

When specific techniques, predictably destined to fail, are touted as sure-fire, and then they fail unexpectedly, it gets to be annoying …

Yes, apologists will try to re-direct the train of thought in more-favourably-spun ways, but, when the train of thought is heading off the rails into the gorge unxpectedly, is it really such a good idea to keep proclaiming that said train’s record for keeping its scheduled arrival on time at the next station continues to be unbroken ?

So, yes, it’s not about Obama … it’s about what Obama/Reid/Pelosi did (and continue to attempt to do), that has taken The Eeeevil Boosh’s ‘unconscionably high’ deficits, and proceeded to tack on an extra mere *trillion* before the hiundreds of billions … we don’t *CARE* how high or low his melanin content may or may not be … we don’t *care* about his haplo-group … his policies and decisions *inhale* !

I also have to suspect that gahrie’s comments tend not to go the hyperbolic “never” and “always” route … the predominance of Obama-defence in the current major media over the past few years is, to quote someone for who I have respect – when one considers the defences of the current Administration and current Senate’s budgetary ambitions – “This is baloney wrapped in bullshit covered with hogwash.” !

As I tweeted after you said you were done:

I accept that the experts are usually wrong when they make their predictions.

I accept that inaccurate predictions can be useful.

I cannot accept the fact that the inaccurate predictions are unexpected.

I cannot accept the fact that it is apparently unreasonable for me to question why when the actual reports prove the predictions wrong, the label unexpected is used.

As you have been arguing, we should in fact expect the results to not match with the predictions.

One of the reason we are not surprised when the weathermen get it wrong, is that no tells us it is unexpected when they do.

Oh well…if I am some crazed wingnut for my position on this issue, at least I am in good company:

http://pajamasmedia.com/instapundit/?s=unexpectedly

You are confusing two completely separate issues, gahrie. You say, “I fault those who tell us to shut up and listen to the experts/elite because they know so much more than us, even though the elites/experts are continuously and predictably wrong.” There, you’re presumably referring to the Geithners and Summerses and Bernankes and Paulsons and Goolsbees and Krugmans of the world — the “experts” who are making policy suggestions and decisions about how we should proceed. But those are NOT the “experts” whose “expectations” are being discussed when the media talks about “unexpected” bad news. Do you think Tim Geithner releases a secret weekly memo to the MSM containing his expectations for that week’s jobs report? No! The “expectations” being discussed are those of the market and of private sector market analysts. It’s the “expectations” of people who are trying to make money (for themselves and their clients), not people who are trying to change national policy.

The “expectations” referenced by the media in this context is just the generic market consensus, as interpreted by analysts, for what the economy is going to do next. The reason it’s valuable and important to understand these “expectations,” and understand the economic news through their prism and context, is not because the expectations are always right — though, please note, you have not actually demonstrated, or even attempted to demonstrate, that they are usually wrong; you’re just cherry-picking headlines, ignoring the overwhelming selection bias inherent in your method, including the fact that “expected” numbers are less newsworthy than “unexpected” ones, and thus generate fewer headlines and make less of an impression — nor have you demonstrated anything about how badly wrong the expectations typically are when they’re wrong — but rather, it’s valuable and important to understand the “expectations” because the market consensus is already priced into the market, so better-than-expected results are “good news” in a market context (even if they’re objectively bad), and worse-than-expected results are “bad news” in a market context (even if they’re objectively good). That is why the comparison between economic news and economic expectations is newsworthy in the first place.

One of the reason we are not surprised when the weathermen get it wrong, is that no tells us it is unexpected when they do.

If the weathermen forecast an 80-degree day and it’s actually 90, nobody says it was unexpectedly warm? Really? Granted, they might not say that when it’s 82 instead of 80, because nobody really cares about that level of difference — whereas in the economic context, the difference matters more. But it’s absolutely true, by definition, that if we expected it to be 80, and it’s 82, or 85, or 90, it’s “unexpectedly warm.” Whether people say that out loud has more to do with the significance and gravity and newsworthiness of the expectations than with the definition of the word “expectation.” If a hurricane takes an unexpected turn at the last minute and calamity is averted (or caused), you can be damn sure people call it “unexpected,” even though we all know hurricanes are unpredictable and sometimes do “unexpected” things. There is no contradiction between recognizing the unpredictability of future events in general, and describing particular instances of that unpredictability as “unexpected.”

Your argument is equivalent to saying that we shouldn’t call it an “upset” when a 12-seed beats a 5-seed in the NCAA Tournament, because some 12-seed beats some 5-seed nearly every year. So it’s not really unexpected that one of them did. But since we don’t know which individual 12-seed will do it, and it’s still legitimately “unexpected” that any specific 12-seed will be the one to do it, it’s absolutely still an “upset.” Only if 12-seeds usually beat 5-seeds — not just ~1 of 4 usually did it, but a majority usually did it — would the “unexpected” become “expected.”

We could talk about this all day, but you remain spectacularly wrong. The only way your position would have merit is if the market consensus were usually wrong (not just sometimes wrong in a newsworthy fashion, which is all you’ve demonstrated). But if the market consensus were usually wrong, then the markets would be essentially random and irrational and non-functional, which surely isn’t what you believe as a market-oriented conservative.

but you remain spectacularly wrong

Well at least I am in good company…….

Similarly, the repeated occurrence of “unexpected” economic news should serve as a wake-up call to supporters of increased government control over the economy. In the words of Ayn Rand, they should “check their premises.” The “unexpected” is reality’s way of telling them they should stop relying on their faulty map of bad leftist economic theories. Otherwise, America may soon face the economic equivalent of “death by GPS,” as is already unfolding in countries like Greece.

http://pajamasmedia.com/blog/why-the-unexpected-keeps-happening/

That would make sense, if the “expectations” being discussed were those of people espousing “bad leftist economic theories.” But they’re not. They’re consensus market expectations, or private-sector analysts’ interpretations thereof. So what you’ve just quoted is a completely false opinion based on a totally untrue premise.

This is how economic data is always reported — in comparison to the consensus market expectations — because otherwise, the numbers would lack context and be nearly meaningless. “Expectations” are the comparison point during good times and bad, during both Republican administrations and Democratic ones, as I’ve already demonstrated in response to your challenges through the trivial use of Google (a fact you haven’t acknowledged or grappled with).

This is just a completely false meme. You beclown yourself by continuing to espouse it.

P.S. This isn’t just true of economic meta-conditions, by the way. Individual corporations’ earnings reports are also routinely compared to market expectations. When you read a headline like “Wal-Mart stocks rise as 3Q report beats expectations” or “G.E. profits below expectations; stocks plunge,” do you think, “Gee, those idiots with their ‘expectations’ should stop relying on their faulty map of bad leftist economic theories”? Or do you recognize that what’s being discussed are consensus market expectations, which form the essential context for understanding any piece of economic data?

This meme is such profound nonsense. It’s a testament to ignorance and blind partisanship that it has any traction at all.

Again, What changed your mind?

I continue to cite those who agree with my position…you, not so much.

Also again, I am quite comfortable being in the company I am.

What changed my mind about what?

As for citing those who agree with your position… lots of people are wrong about lots of stuff. I could site people who agree with all sorts of ridiculous positions. So what? I don’t care if the President, the Pope, and Stephen Hawking all agree with your position. It’s still empirically wrong. I’ve demonstrated that with facts and logic, which you ignore.

One thing that would be helpful would be if you would settle on a theory. You keep switching your hypothesis, which is convenient way to avoid admitting you’re wrong when I demonstrate the fallacy of one of your alternative theories. So, let’s be clear. Which do you believe?

* Reported “expectations” are biased toward being overly optimistic (and thus reality is usually “unexpectedly bad”), during Democratic administrations only, because the media is consciously shilling for the Democrats.

* Reported “expectations” are biased toward being overly optimistic (and thus reality is usually “unexpectedly bad”), during Democratic administrations only, because the media honestly believes in “bad leftist economic theories” and thus sets its own (genuine but misguided) internal “expectations” too high.

* Reported “expectations” are biased toward being overly optimistic (and thus reality is usually “unexpectedly bad”), during Democratic administrations only, because the media is relying on administration-approved “experts” to furnish the “expectations,” and those “experts” are either shilling for the administration or relying on misguided liberal theories.

* Reported “expectations” are biased toward being overly optimistic (and thus reality is usually “unexpectedly bad”), regardless of which party is in power. I’m not sure why this one would be true; maybe you can provide me with a rationale, if you believe it.

* Reported “expectations” aren’t biased in any particular direction — sometimes things are “unexpectedly good,” sometimes “unexpectedly bad” — but regardless, “expectations” are usually wrong, during Democratic administrations only, because the media is relying on administration-approved “experts” to furnish the “expectations,” and those experts are liberal idiots.

* Reported “expectations” aren’t biased in any particular direction — sometimes things are “unexpectedly good,” sometimes “unexpectedly bad” — but regardless, “expectations” are usually wrong, regardless of which party is in power, because economic “experts” in general are idiots.

Which is it?? It can’t be all six. There are differing and conflicting premises in those various hypotheses. You tend to retreat to #6 when I make valid arguments against any or all of the first 5, but then you always eventually return to one or more of the others again, as you did with this most recent comment.

The slippery nature of your presentation of this argument allows you, I think, to operate under the illusion that the individual components or alternative theories of the argument hasn’t been as thoroughly debunked as they have. So I’d like to pin this down. What, exactly, do you believe, gahrie? Which of these theories do you think is true, or most true?

1) I believe the MSM deliberately slants its coverage to benefit President Obama. This is true whether it is economics or anything else. Why is Bachmann”s “gaffes” such as mixing up John Wayne’s and John Wayne Gacy’s birthplace headline news for three days, and yet no one covered President Obama confusing the names of two Medal of Honor winners whose medals he awarded?

2) * Reported “expectations” aren’t biased in any particular direction — sometimes things are “unexpectedly good,” sometimes “unexpectedly bad” — but regardless, “expectations” are usually wrong, regardless of which party is in power, because economic “experts” in general are idiots.

This, except I would say that the experts aren’t idiots. I’d say they are wrong for the same reason meteorologists and pro-AGWers are wrong…the system is simply too complex to accurately predict the future. My beef isn’t necessarily with the experts, it is with those who demand we listen to the pronouncements of the “experts” as if they were oracles of old.

I assume you apply the same lack of credibility of the experts in climate science, with mounds of scientificly valid evidence to back up their claims, to something like say, oh doctors? When your doctor asks you to come in for more tests or to take a specific medicine I assume you ignore them too? Or do you, like most Republicans only ignore science and learning when it is politically inconvenient to acknowledge it.

I continue to be astounded to the levels which the right wing will go to ignore the very real data behind global climate change simply because it is a cause that liberals are behind. I can think of no other reason why they would oppose something that is so clearly obvious from the data and the science (melting glaciers, the impacting of rising CO2 levels, etc.) I mean honestly, beyond ideological grandstanding whats the point??

I don’t know about you, but my doctors don’t have a consistent track record of being wrong. They also don’t refuse to share their data.

When your doctor asks you … to take a specific medicine I assume you ignore them too? Nope…but I don’t automatically accept his recommendations as gospel either.

You’re using outdated talking points David.The glaciers aren’t melting. Some glaciers are melting, others are growing. Glaciers are growing in Greenland, the US, South America and Nepal for starters.

What impact has rising CO2 had on our lives? It has had no impact on my life. (beyond of course the creation of the whole AGW scam.

By the way, has anyone else noticed that the first and loudest attack on AGW skeptics is that they are in the pay of the oil companies? Yet how many AGW skeptics have become millionaires off the fight over AGW and how many of the AGW proponents have become millionaires off the fight?

You know..I’ve changed my mind (not really). I believe in AGW. I think AGW is so serious, that I think we should ignore CO2 (which is a very minor greenhouse gas by any measure) and instead concentrate on the greenhouse gas that is by far the largest and most dangerous contributor to retaining heat, and that is Dihydrogen Monoxide vapor.

We must immediately cripple any activity that produces Dihydrogen Monoxide for the sake of the polar bears!

gahrie – you are *SO* right !

Far too many of our children, our brothers and sisters, our cousins and aunts and gibbons, die of dihydrogen monoxide toxicity every year !

Capitalist exploiters of our innocent children add dihydrogen monoxide to soft drinks ! Unscrupulous politicians try to persuade our citizens to consume more of it, touting it as a “healthy” thing to do, ignoring the thousands of people who die from a dihydrogen monoxide overdose each year !

All around the planet, wars have been fought over dihydrogen monoxide !

Perhaps we can get David K to put up a petition to Ban Dihydrogen Monoxide, and we can all encourage our friends and family to sign it …

Under Obama, “unexpectedly bad” ends up being “much worse.”

Speaking of revisions, most Americans are probably unaware of what has happened to initial government data since Democrats took control of Congress in 2007. In revisions over the following months and years, already “unexpectedly” bad results have almost invariably gotten worse — often much worse.

….as long as the Obama administration stays on its current course of reckless spending, regulatory tyranny, and childish insistence on tax increases that will self-evidently make things worse, one does not need to possess psychic powers to know that we can count on “unexpectedly” bad economic news followed by additional, steep downward revisions.

http://pajamasmedia.com/blog/revisionomics/

And the unexpectedly just keeps on happening …

“The number of planned layoffs at U.S. firms rose to a 16-month high in July as sectors which had been seeing fairly few layoffs unexpectedly bled jobs, a report Wednesday showed.” …

This is definitely a case where the trend is not your friend. Not only do the numbers continue to get worse unexpectedly, but the numbers keep getting revised to worse numbers…….

The number of people who filed for unemployment assistance in the U.S. last week rose unexpectedly, official data showed on Thursday.

In a report, the U.S. Department of Labor said the number of individuals filing for initial jobless benefits in the week ending August 19 rose by 5,000 to a seasonally adjusted 417,000, confounding expectations for a decline to 405,000.

The previous week’s figure was revised up to 412,000 from 408,000.

http://www.forexpros.com/news/economic-indicators/u.s.-initial-jobless-claims-rise-unexpectedly-222628

I wonder what the numbers of “individuals filing for initial jobless benefits” were during the period 2001-2008 ? I’d even go out on a minor limb and speculate that 2001-2006 would show one pattern (with September 11 causing a discontinuity from which it would take time to recover) and 2007-2008 would show a different pattern … I would also speculate that 2009-2010 would be a steeper version of 2007-2008 …

http://www.nationalreview.com/articles/print/275606

“If you ever have to get into a fistfight, make sure your opponent is an economist often consulted by the mainstream media, because that way you’ll always have the element of surprise.”

ROTFLMFO !

The number of Americans filing new claims for jobless benefits rose unexpectedly last week, further evidence of a weak labor market just hours before President Barack Obama unveils a plan on job creation in a major address to Congress.

Yet more “unexpected” bad news.

Applications for unemployment benefits rose to 414,000 in the week ending September 3 from an upwardly revised 412,000 the prior week, the Labor Department said on Thursday. Wall Street analysts had been looking for a dip to 405,000.

And the previously worst than expected numbers continue to be revised to be worse….

http://finance.yahoo.com/news/New-jobless-claims-rise-to-rb-3640825807.html?x=0&sec=topStories&pos=main&asset=&ccode=

I can’t find the link now, but somebody was criticizing this feature a while back as “juvenile.” Well, I am quite deliberately rubbing it in, as the ridiculously inflated expectations for Obama are regularly and repeatedly exposed as . . . ridiculously inflated. But what’s really juvenile is expecting that an inexperienced former community organizer could successfully execute the office of President of the United States. And if I’m peeing all over the wave of hope-and-change hype that got him into office despite his obvious unsuitability, it’s to help ensure that nothing this disastrous happens again in my lifetime. I realize that it’s painful for those who fell victim to the mass hysteria to constantly be reminded of their foolishness, but I hope it’ll be the kind of pain that results in learning. . . .

http://pajamasmedia.com/instapundit/127567/

The number of Americans filing new claims for jobless benefits rose unexpectedly last week in a sign concerns about a weak economy were sapping an already beleaguered labor market, data showed on Thursday.

At what point do they just start recycling the stories by simply changing the date each week?

http://www.chicagotribune.com/business/sns-rt-us-usa-economy-instanttre78e2t5-20110915,0,450658.story

http://phinphanatic.com/files/2007/11/dead-horse1.jpg

As long as we get weekly pronouncements of “unexpectedly” bad news and downward revisions of previously unexpectedly bad news, I will continue to beat that dead horse.

Sado-masochistic necrophiliac bestiality is a classic davidkian trait, is it not, gahrie ?

“Have been tracking those revisions as well. My numbers show the last 26 weeks have had an average revision of up 3,884 with no downward revisions and only one revision of zero. Talk about lying with statistics.”

http://pajamasmedia.com/instapundit/130075/

12/1/11:

Claims for unemployment insurance unexpectedly rose last week, climbing past the psychologically important 400,000 mark as the jobs market showed signs of more weakness.

http://www.cnbc.com/id/45506837

4/26/12

Recall what we said less than an hour ago: “what will most likely happen is a print in the mid to upper 380,000s, while last week’s number will be revised to a 390K+ print, allowing the media to once again declare that the number was an improvement week over week. In other words, SSDD.” SSDD it is: last week’s 386K number was revised to 389K, meaning the massive miss relative to expectations of 370K last week just got even worse. This is the 10th week in a row of misses to the weaker side and the 16th of the last 18. And while this week’s miss was whopping as usual, with expectations of 375K being soundly missed after the print came at 388K on its way back to 400K, the media can sleep soundly because the absolute lack of BLS propaganda means that the sequential progression is one of, you got it, improvement. In other words here is what the headlines in the Mainstream Media will be: “Initial claims improve over prior week.” In fact here it is from Bloomberg: “U.S. Initial Jobless Claims Fell 1,000 to 388,000 Last Week.” Absolutely brilliant.No propaganda. No data fudging. No manipulation at all. Just endless laughter at the desperation.

http://www.zerohedge.com/news/just-predicted-initial-claims-miss-huge-yet-magically-improve

http://www.jammiewf.com/2012/unexpected-jobless-claims-inflation-and-deficit-all-rise/

I wonder if we’ll still see poor economic news described as “unexpected” next year if romney gets elected?

Anyone want to bet that the poor and homeless will return to the news if romney is elected?

This is the 22nd expectations miss in the last 25 reports.

http://www.zerohedge.com/news/initial-claims-miss-big-people-falling-extended-claims-soar-135k-cpi-plunges-most-december-2008

Initial claims for state unemployment benefits slipped 2,000 to a seasonally adjusted 387,000, the Labor Department said. The prior week’s figure was revised up to 389,000 from the previously reported 386,000

So, by manipulating statistics, the media was able to report a rise of 1,000 more jobless claims from the number reported last week as 2,000 fewer jobless claims,

Genius.

At least until next week when this weeks number will be revised upwarded yet again.

http://www.foxbusiness.com/economy/2012/06/21/jobless-claims-fall-4-week-average-highest-since-december/?test=latestnews

Well…surprise, surprise, surprise…

The number of Americans filing new claims for unemployment benefits fell last week, government data showed on Thursday, but remained too high to signal any major improvement in the labor market. Initial claims for state unemployment benefits fell 6,000 to a seasonally adjusted 386,000, the Labor Department said. The prior week’s figure was revised up to 392,000 from the previously reported 387,000.

So…last week’s artifically produced “2,000 fewer unemployment claims” was actually 3,000 more unemployment claims than two weeks ago.

Anyone want to take my bet that next week, this week’s numbers will be adjusted again, and most, if not all, of this week’s 6,000 drop will disappear?

http://www.foxbusiness.com/economy/2012/06/28/jobless-claims/?test=latestnews

Initial claims for state unemployment benefits dropped 14,000 to a seasonally adjusted 374,000, the Labor Department said. The prior week’s figure was revised up to 388,000 from the previously reported 386,000.

Well……

The previous week’s number was revised upwards for at least the third week in a row, this time by 2,000 claims. That cut last week’s drop in claims by a third, and produced an extra 2,000 claim drop in this week’s numbers.

Any bets on next week? or tomorrow’s numbers for June?

http://www.foxbusiness.com/economy/2012/07/05/jobless-claims-notch-biggest-drop-in-two-months/

On January 24, 2009, President Obama’s first week in office, there were 133,886,830 people in the labor force. (7.8% unemployment) The week of June 9, 2012 there were 127,048,587 people in the labor force. (8.2% unemployment) That is nearly 7 million fewer people working today in the United States. Unemployment has not dropped to less than 8.1% since President Obama’s first week in office.

On January 20, 2001, President Bush’s first week in office, there were 126,843, 537 people in the labor force. (4.2% unemployment) On 6/5/2004, there were 126,084,041 people in the labor force. (5.6% unemployment) Which means that even after dealing with the aftermath of 9/11 There was only a drop of 3/4 of a million workers. By the end of President Bush’s term, there were 133,886,830 workers, meaning that 7 million jobs were added during the Bush presidency.

The last three employment snapshots released by the Labor Department have been persistently weak, and marked a distinct slowdown from earlier in the year. In the latest report, the department said employers added a meager 80,000 jobs in June, leaving the unemployment rate unchanged at 8.2 percent. The number of jobs added in June was lower than expected, and rounded out a poor second quarter for 2012.

(bolding mine)

http://www.foxnews.com/politics/2012/07/06/employers-add-just-80000-jobs-in-june-unemployment-rate-stays-at-82-percent/

Initial claims for state unemployment benefits dropped 26,000 to a seasonally adjusted 350,000, the Labor Department said.

The drop, which brought new claims to their lowest level since March 2008, was much steeper than Wall Street economists expected.

The prior week’s figure was revised slightly higher to 376,000 from the previously reported 374,000.

Well…lets see:

the previous weeks number revised upwards? Check

revised up by an average of 2,000 claims? Check

unexpected economic news? Check

At least the really low number is good news, right?

A Labor Department official noted that part of the drop might be due to some auto manufacturers keeping their plants open during the first week of July to meet demand.

Normally plant closures during that week would lead to a spike in jobless claims, but they did not materialize. That suggests part of the strength in the labor market last week might be due to temporary factors.

see ya next week…..

http://www.foxbusiness.com/economy/2012/07/12/weekly-jobless-claims-hit-four-year-low/

Retail sales in the U.S. unexpectedly fell for a third month in June as limited employment gains took a toll on consumers.

http://www.bloomberg.com/news/2012-07-16/retail-purchases-in-u-s-unexpectedly-decreased-0-5-in-june.html

Initial claims for state unemployment benefits increased 34,000 to a seasonally adjusted 386,000, the Labor Department said on Thursday. The prior week’s figure was revised up to 352,000 from the previously reported 350,000.

Ok…

the previous weeks number revised upwards? Check

revised up by an average of 2,000 claims? Check

unexpected economic news? well, they didn’t use that term this week…….

http://www.cnbc.com/id/48239619

Note also that last week’s week’s 26,000 claim drop, and the previous week’s 14,000 claim drop have all disappeared.

Initial claims for state unemployment benefits dropped 35,000 to a seasonally adjusted 353,000, the Labor Department said on Thursday.

That was a much sharper drop than economists expected. The prior week’s figure was revised slightly higher.

the previous weeks number revised upwards? Check

revised up by an average of 2,000 claims? Hmm…the article doesn’t say what the revision to last week’s numbers was..off to the dept of Labor…well surprise , surprise, the number was revised upwards by….2,000 claims.

unexpected economic news? yep, granted, the news is unexpectedly better this week….

Note: This week’s number of 353,000 is still 1,000 claims higher than the revised number from two weeks ago.

http://www.foxbusiness.com/economy/2012/07/26/jobless-claims-fall-more-than-expected/

http://www.dol.gov/opa/media/press/eta/ui/eta20121515.htm

Separately, factory orders unexpectedly fell in June, the latest sign that the slowing economy is sapping demand.

Initial jobless claims, an indication of layoffs, increased by 8,000 to a seasonally adjusted 365,000 in the week ended July 28, the Labor Department said Thursday. Economists surveyed by Dow Jones Newswires had forecast 370,000 new applications for jobless benefits last week.

Claims for the July 21 week were revised up to 357,000 from an initially reported 353,000.

the previous weeks number revised upwards? Check

revised up by an average of 2,000 claims? nope..double that this week…..

unexpected economic news? check……

http://online.wsj.com/article/SB10000872396390443687504577564761715307088.html

The U.S. economy closed out an otherwise weak second quarter by creating more jobs than expected, with 163,000 new positions added, but the unemployment rate rose to 8.3 percent. Markets reacted positively to the announcement, with stock futures indicating gains at the Wall Street open. Economists had been expecting 100,000 new jobs.

As the country struggles to gain growth traction, the unemployment rate held above 8 percent for the 41st consecutive month, according to the latest report from the Bureau of Labor Statistics.

“While the monthly gain is still relatively small by historical standards, it might help spxark somewhat higher consumer optimism and spending,” Kathy Bostjancic, director of macroeconomic analysis at The Conference Board, said in response to the report.

Despite the seemingly good news, the report’s household showed that the actual amount of Americans working dropped by 195,000, with the net job gain resulting primarily from seasonal adjustments in the establishment survey. The birth-death model, which approximates net job growth from newly added or closed businesses, added 52,000 to the total.

The household survey also showed 150,000 fewer Americans in the workforce.

http://www.cnbc.com/id/48480887

Did you get that? We “added” 163,000 jobs last month using statistics, even though there are actually 150,000 fewer people working this month than last month.

Demand for US factory goods fell unexpectedly in June, reflecting a drop in corporate investment and the biggest decreases in non-durable goods orders for over three years.

Factory orders fell 0.5 per cent, compared with analysts’ expectations of a 0.7 per cent rise, US commerce department figures showed yesterday. June’s fall followed a downwardly revised 0.5 per cent increase in May, after sharp declines the two previous months.

http://www.irishtimes.com/newspaper/finance/2012/0803/1224321368614.html

Ballotpedia has compiled data on the average net worth of our elected officials for the years 2004 to 2010. As the average net worth of Congress has increased since 2004, and held about even from 2007 to 2010, the average American family net worth dropped 40 percent from 2007 to 2010 to an average of $77,300.

In 2010, the average net worth for a U.S. senator was $13,224,333. The average net worth for a Democratic senator was $19,383,524, compared to $7,054,258 for a Republican senator. That’s a difference of $12.3 million.

http://legalinsurrection.com/2012/08/the-congressional-wealth-gap/

The number of Americans filing new claims for jobless benefits unexpectedly fell last week,

government data showed on Thursday, suggesting a modest improvement in the labor market.

Initial claims for state unemployment benefits slipped 6,000 to a seasonally adjusted 361,000, the Labor Department said. The prior week’s figure was revised up to 367,000 from the previously reported 365,000.

Economists polled by Reuters had forecast claims rising to 370,000 last week. The four-week moving average for new claims, a better measure of labor market trends, rose 2,250 to 368,250.

the previous weeks number revised upwards? Check

revised up by an average of 2,000 claims? Check

unexpected economic news? check……

Initial claims for state unemployment benefits slipped 2,000 to a seasonally adjusted 366,000, the Labor Department said on Thursday. That was in line with economists’ forecasts in a Reuters poll.