@slmandel: Paul Dee at a 2007 infractions hearing: “You have to put in place the kind of institutional control we hav… (cont) http://t.co/tMafeCi

msnbc_weather: The haboob…

@msnbc_weather: The haboob returns! Another wall of dust hits Phoenix http://t.co/TxR8JJz

hurricanes: Atlantic trop…

@hurricanes: Atlantic tropical system is a potential U.S. threat next week says Weather Channel http://t.co/04p222p

rushthecourt: Um, WOW. G…

@rushthecourt: Um, WOW. Georgetown brawl video – http://t.co/G1zt9XM!

“Showmanship, not leadership”

Of all the things I tweeted during last night’s Republican presidential debate in Iowa, none was more surprising — including to myself — than this one: “SANTORUM FTW.”

And I wasn’t being sarcastic. Rick Santorum, the archconservative also-ran from Pennsylvania, with whom I disagree about most everything — especially gay rights — thrilled me enough to bust out that unironic “FTW” (“For The Win”) because of this response to Michelle Bachmann’s (and Ron Paul’s!) ongoing cavalcade of sheer nonsense with regard to the debt ceiling:

He’s wrong, of course, about “focusing” on the Balanced Budget Amendment. But on the fantasy of never raising the debt ceiling under any circumstances, he’s dead on. Wonder of wonders, he actually does math, and throws some facts into the debate. Amazing!

As I tweeted afterward:

![]() Rick Santorum actually does math, calls out Bachmann on “showmanship, not leadership” re: debt ceiling. THANK YOU!! #SantorumHaters4Santorum

Rick Santorum actually does math, calls out Bachmann on “showmanship, not leadership” re: debt ceiling. THANK YOU!! #SantorumHaters4Santorum

![]() Santorum did in 30 seconds what the bulk of the media failed to do for months. #ThankYouRickSantorum

Santorum did in 30 seconds what the bulk of the media failed to do for months. #ThankYouRickSantorum

![]() Re: Bachmann, debt ceiling, facts & math, media should be utterly, deeply ashamed that RICK SANTORUM is doing its job for it. #4thEstateFAIL

Re: Bachmann, debt ceiling, facts & math, media should be utterly, deeply ashamed that RICK SANTORUM is doing its job for it. #4thEstateFAIL

Party like it’s 2008?

Are we experiencing a repeat of the 2008 financial crisis? The New York Times explores the question. It’s a good overview; I encourage you to read the whole thing. I am inclined to side with the pessimists, but I hope I’m wrong.

More broadly, I fear we’ll look back at 2010 as a “dead cat bounce” rather than a genuine (if weak) recovery between recessions, and likewise we’ll view 2011 through whenever not as a “double dip,” but as part two of an ongoing Great Recession/Depression that started in 2007 and has not yet truly ended, and won’t for a while. The structural flaws in the U.S. and global economies that were thrown into sharp relief in 2008 and 2009, then masked by frantic government efforts to prevent a depression, have not actually been solved, even if analysts and investors spent much of 2010 and early 2011 ignoring them and trying to forget about them. The housing market is still in deep doo-doo; global trade imbalances are still massive; we still don’t have a plan for replacing excessive, debt-fueled consumer spending as the “engine of the economy”; and we’ve simply shifted a lot of debt from companies to governments, so instead of too-big-to-fail banks threatening the stability of the economy, we have too-big-to-fail countries doing so, with no one left to backstop them or bail them out (and no political will for additional bailouts of any kind anyway).

Frankly, I never really understood the optimism of 2010 — it always seemed like the argument for pessimism was detailed and nuanced and well-thought-out, while the argument for optimism was basically “meh, we’ll muddle through, somehow or other.” But I partially supressed my doubts because I recognize my own lack of knowledge in this area, and have little choice but to trust the experts. Yet those experts made a lot of valid-seeming points back in 2008-09 about the depth of the problems broadly underlying the crash, and I’ve never really understood the logic of expecting a lasting recovery, even a weak one, before we make more progress toward solving those problems. To make a college football analogy (P.S. THREE WEEKS TILL KICKOFF!!! WHEE!!!), the “recovery” of 2010 felt like a situation where a team is widely and reasonably expected to struggle, because it lacks a proven QB or a solid defense, but then it pulls a somewhat flukey upset in its first game, and suddenly it’s deemed a national title contender… even though it still lacks a proven QB or a solid defense. The pessimists still have the better of the argument, and will probably be proven right in the end.

All the hand-wringing about corporations hoarding cash, holding onto their record profits instead of investing or hiring, misses the possibility that these companies are just more clear-eyed than the rest of us, and recognize what I increasingly suspect is true: that we’re in for a very rough decade, and building up a rainy-day fund (or a rainy-decade fund) before the s**t hits the fan — again — might not be such a bad idea. Again, I hope I’m wrong.

Rick Perry: Texas A&M to secede?

We interrupt the Everything Seemingly Is Spinning Out of Control Watch — STOCKS CRASHING! ECONOMY CRATERING! DEBT SOARING! OBAMA FLAILING! ENGLAND BURNING! BACHMANN’S EYES BULGING! — to bring you something else to #PANIC about… in the world of college sports! With bonus Rick Perry secessionist action! (No, not that kind of secession.)

The Texas A&M Aggies, a.k.a. the Brett Favre of the 10-team Big Twelve, are at it again. Rumors about an A&M move to the SEC — which would probably result, finally, in the disintegration of the Big XII, causing massive ripple effects across college sports, up to and including the formation of four 16-team superconferences, the end of Notre Dame’s independence, the destruction of the NCAA as we know it, and/or the Rapture — have resurfaced as a hot topic in the last 24 hours, with increasing numbers of respected journalists saying their sources are lending credence to the possibility of major news soon. Like, maybe an announcement on or around August 22?

And now, in the past hour or two, the topic has gone from “hot” to “surface-of-the-sun hot,” thanks to… wait for it… Rick Perry!!

Asked by The Dallas Morning News ’ statehouse reporters about SEC speculation regarding A&M, Perry responded: “I’ll be real honest with you. I just read about it the same time as y’all did. … As far as I know, conversations are being had. That’s frankly all I know. I just refer you to the university and the decision makers over there.”

The key phrase is “As far as I know, conversations are being had.” The response by the governor, a former Aggie yell leader and likely future presidential candidate, went beyond the Twitter and message board speculation that erupted in the last 48 hours.

Perry didn’t say if the conversations were strictly internal at this point or involved direct discussions with the Southeastern Conference.

Maybe Perry’s big announcement on Saturday isn’t that he’s running for president; it’s that Texas A&M is joining the SEC #WAR!!!!

In all seriousness, it’s not clear to what extent Perry is just regurgitating rumors, repeating things he “read about the same time as y’all did,” and to what extent he is actually relaying inside information. But the man is a former Aggie Yell Leader, and he’s been the governor of Texas for a decade, so he presumably knows everybody in all the relevant positions of power. This is causing lots of folks to take notice.

The best Twitter reaction to the news? That belongs to Luke Zim, who writes, “Rick Perry’s run for President just to get A&M in the SEC is the most elaborate college football fanatic move of all-time.”

Fear! Fire! Foes! Awake!

Hey, I needed a different title than #PANIC. Already used that one. And I’m saving #DOOM for a plunge of 800 points / 8% or more. (Tomorrow! Tomorrow! I love ya, tomorrow!) Anyway…

I have a pet theory about this. Sometimes, I think Wall Street gets what it wants from politicians, expecting to feel reassured by it — but instead, investors realize, “wait a minute, I’m still freaked out,” and then they sell. I recall something like this happening after the stimulus passed and/or after TARP succeeded on take 2 (I can’t recall which, or if it was both). It happened last week after we averted default. And I think it might be happening now, with regard to the European Central Bank’s much-anticipated decision to buy Italian and Spanish bonds.

I know we Americans want to make this all about us, as per usual, but really, Europe is the primary risk at the moment, methinks. The S&P downgrade is mostly just a potent symbol; its substance is based on stuff everyone already knew. It alone shouldn’t tank the markets like this. But in combination with continued European fears, and broader economic anxieties? Yeah. This is a classic #PANIC.

[/armchair market analysis]

More pretty (ugly) charts after the jump!

Two scary economic charts

As if recent events haven’t created enough cause for #PANIC already, I’ve recently seen a couple of charts of economic data that really put things into (scary) perspective.

One is the “real” monthly employment picture since 2009, subtracting out the 150,000 jobs that must be added per month just to keep up with population growth:

Yikes.

The other requires a bit more explanation. Nate Silver explains:

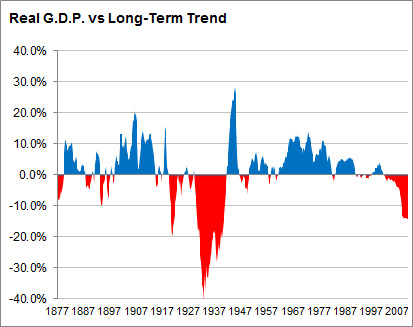

The rate of growth [in the U.S. economy] has in fact been quite steady over the long run: since 1877, the annual rate of G.D.P. growth has averaged about 3.5 percent after inflation. … I’ve plotted how far ahead or below of the long-term trend that the economy is at any given time. …

Here, you can really see the effects of the Great Depression. In early 1933, G.D.P. was about 40 percent below what it “should” have been based on long-term growth rates. But the economy recovered at a rapid clip over the course of the next decade. In fact, G.D.P. temporarily overshot, exceeding the long-term trend during World War II as America employed all the industry and labor that it could get its hands on to help with the war effort.

By this measure, most post-World War II recessions are barely detectable. They look more like reversions to the mean after years of above-average growth.

The Great Recession, however, is highly visible. G.D.P. had already been a couple of percentage points below the long-term trend before it began, as the recovery from the 2001-2 recession was not particularly robust. But things got much worse in a hurry.

Looked at this way, in fact, not only is the worst not yet over — the situation is still deteriorating. Every quarter that the economy grows at a rate below 3.5 percent, it loses ground relative to the long-term trend. Although the economy grew at a 3.8 annual percent rate from fall 2009 through summer 2010, over the past year growth has averaged just 1.6 percent, putting us farther behind.

Right now, gross domestic product is about $13.3 trillion dollars, adjusted for inflation — when it “should” be $15.7 trillion based on the long-term trend. That puts us more than 15 percent below what we might think of as full output, by far the worst number since the Great Depression.

If the economy were to enter another recession and shrink by 1 percent over the course of the next year, we would wind up 19 percent behind the long-term trend. But even if it were to grow at 2 percent, we would still be 17 percent behind.

What we need, instead, is above-average growth — in fact, quite a lot of it. Even if the economy were to begin growing at a 5 percent annual rate, it would take until 2018 for it to catch up to the long-term trend.

Anyone think that’s gonna happen?

Realistically, we’re looking at that ugly red dip extending well into the 2020s. At some point, doesn’t such an extended period of economic difficulty start to approach a functional definition of “depression”? Or at least a “lost decade” or two?

Beaver Creek

Some photos from my weekend in Beaver Creek:

That last one was an unintentional snapshot as I moving the phone into or out of my pocket. I think it turned into a rather cool abstract photo.

More photos here.